By Savita Gill, Michelle Leung, and Annie Xu

In January 2012, 150 workers at Foxconn threatened mass suicide in protest of their poor working conditions (Moore, 2012). In November 2012, over 112 workers died in fire at a factory operated by Tazreen Fashions Ltd. In Dhaka, Bangladesh (The Associated Press, 2012). What did these two incidents have in common? The companies involved were both suppliers to large and powerful American companies. Foxconn was a supplier to Apple, whereas Tazreen was a garment supplier to Walmart. Both Apple and Walmart were and continue to be heavily criticized for not taking a larger and more active role in ensuring the quality and safety of the working conditions at their suppliers, but is it really their responsibility? As the largest company by revenue in the world, Walmart is an easy target. In this blog post, we shall argue that Walmart should not be held responsible or accountable for what happens at its tens of thousands of suppliers.

The local government shall be held fully responsible for the working conditions and safety of its people and factories. The Rana Plaza tragedy in Bangladesh is one example where the government should have enforced its laws and regulations to protect its factory workers. The collapse of the building that took over 1100 lives was due to the extra two floors that were illegally added to the building. If government regulation and inspection were tightly in place, the tragedy would not have happened. Some argue that corporations such as Loblaws, Wal-Mart and JC Penny should be held accountable for the conditions and safety of the factories such as the Rana Plaza; but the truth is that this would never be possible as multiple layers of contractors are in place disconnecting the North American corporations from its source of goods. In addition, corporations cannot uphold their own laws and regulations in another country. Wal-Mart’s clothing line supplier contracts the production of the garment to a clothing company where it then contracts to a Bangladeshi manufacturer who then contracts to a local shop that makes clothes for multiple North American corporations. With so many levels of sub-contracting and the factories being half way around the world, Wal-Mart does not have the ability to have a say on how its clothing are made, nor could Wal-Mart walk into Bangladesh and start giving orders on how things should be done even if Wal-Mart wanted to. To make the change of safe working conditions to happen, it takes the local government, business alliances and pressure from the media. In 2002, China passed the bill on Child labour law after much criticism from the West and threads to move factories elsewhere. Now with local government enforcement, the condition has improved, children’s rights are being protected and maltreatment of children is prohibited. In 2001, US government and Cambodia government came into agreement that US would open more opportunities to Cambodia if the Cambodian factory working condition improves. It’s been 14 years since the founding of “Better Factories Cambodia”, both the government and the foundation are still working hard to ensure the factories comply with the rules and regulations of international labour standards. Local government intervention is absolutely necessary for the working conditions and safety to improve.

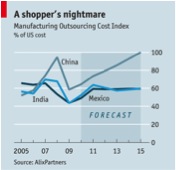

Secondly, international coherence on core labor standards is an issue much beyond the realm of Wal-Mart. Placing a developing country under the same lens as an economically developed country can be seen as a protectionist measure. It will impact country’s competitive advantage and hence net export and hence economic development. In addition, every Fortune 500 Company is leveraging low-cost manufacturing to improve bottom line. Wal-Mart is just one player in this ecosystem. So, nations and business communities across the world need to address these hard questions and balance diverse interests. WTO (World Trade Organization) has deferred negotiation of work standards to the International Labour Organization (ILO). WTO points that “it is not easy for member governments to agree on these issues and the question of international enforcement is a minefield” (WTO, 2015). If governments themselves are reluctant to protect their citizens then Wal-Mart faces an uphill task. As a publically listed company with multiple stakeholders, Wal-Mart has taken steps in the right direction with an alliance for Bangladesh and “Responsible Sourcing program”. Wal-Mart should continue to have dialogues around sustainability and better working conditions but cannot be hold accountable if something slips out.

There is no dispute that Walmart has the power to coerce their suppliers to comply with whatever conditions they demand, however, it should not be Walmart’s responsibility to govern the operations and policies of its suppliers. In the end, it is simply a basic business transaction. If Walmart becomes aware of illegal practices and unsafe conditions at its suppliers, they should terminate the relationship if the supplier is not willing to comply with the local laws and regulations. They should not be interfering with how another business operates. Walmart has taken steps to be socially responsible through various initiatives such as participation in the Alliance for Bangladesh Worker Safety. It is now up to local governments and pressure from the world stage to ensure the necessary laws and regulations are in place to guarantee the safety and well being of workers around the world.

References

Moore, M. (2012, January 11). ‘Mass suicide’ protest at Apple manufacturer Foxconn factory. Retrieved January 25, 2015, from The Telegraph: http://www.telegraph.co.uk/news/worldnews/asia/china/9006988/Mass-suicide-protest-at-Apple-manufacturer-Foxconn-factory.html

The Associated Press. (2012, November 25). Bangladesh fire kills 112 at Wal-Mart supplier. Retrieved January 25, 2015, from CBC News: http://www.cbc.ca/news/world/bangladesh-fire-kills-112-at-wal-mart-supplier-1.1179644

WTO. (2015). http://www.wto.org/english/thewto_e/whatis_e/tif_e/bey5_e.htm. Retrieved from http://www.wto.org/: http://www.wto.org/english/thewto_e/whatis_e/tif_e/bey5_e.htm

BFC. (2015). http://betterfactories.org/?page_id=25. Retrieved January 25, 2015, from http://betterfactories.org/: http://betterfactories.org/?page_id=25

Bangladesh Worker Safety Org. (2015) http://www.bangladeshworkersafety.org/. Retrieved January 25, 2015, from: http://www.bangladeshworkersafety.org/

ILO. (2015). http://www.ilo.org/dyn/natlex/docs/WEBTEXT/63806/65269/E02CHN01.htm. Retrieved January 25, 2015, from: http://www.ilo.org/dyn/natlex/docs/WEBTEXT/63806/65269/E02CHN01.htm

Library of Congress. (2015). http://www.loc.gov/law/help/child-rights/china.php. Retrieved January 25, 2015, from: http://www.loc.gov/law/help/child-rights/china.php

Tyson, L. (2014, February 7). The Chalenges ofRunning Responsible Supply Chain. Retrieved January 25, 2015, from Econmix: http://economix.blogs.nytimes.com/2014/02/07/the-challenges-of-running-responsible-supply-chains/?_r=0