By Andrew Barkman, David Barreca and Andrew Deluce

Wal-Mart, the world’s largest company by many measures, could be considered an easy and obvious target of criticism and scrutiny. Many believe the value-driven discounter to be an unstoppable force, a reasonable assessment of a business with annual revenues that rival many developed nations’ GDPs.

But with such a great scale comes the difficulty in adapting to new forces and new markets.

As their physical presence in the American marketplace approaches saturation, Wal-Mart has looked abroad to continue to grow their operations. However, their clumsy entry and prolonged expansion in the Chinese market have underlined fundamental flaws in this international expansion strategy.

As their physical presence in the American marketplace approaches saturation, Wal-Mart has looked abroad to continue to grow their operations. However, their clumsy entry and prolonged expansion in the Chinese market have underlined fundamental flaws in this international expansion strategy.

These flaws not only question the continued viability of international expansion for the 52-year old behemoth from Bentonville, but these difficulties are ones that could easily become apparent in the American market in the near future.

Developing economies are adapting to 21st century retail markets much faster than developed economies

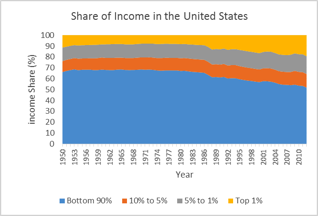

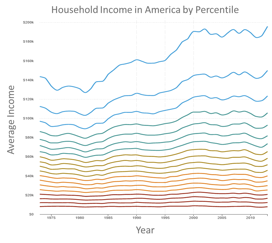

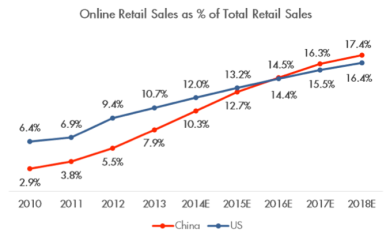

The rapid proliferation and adoption of online retailing in China is transforming the traditional consumer’s shopping behaviour. A historical underdevelopment of the Chinese retail sector[i] has created a void that is being aggressively filled by merchants bypassing brick and mortar stores and developing natively as e-commerce retailers, such as Alibaba. This act of leapfrogging is analogous to the construction of mobile communication networks in many developing nations without first building landline infrastructure. As a result, perhaps, it is predicted that China will surpass the United States in online purchases as percentages of overall sales in the next year (Figure 1).

The rapid proliferation and adoption of online retailing in China is transforming the traditional consumer’s shopping behaviour. A historical underdevelopment of the Chinese retail sector[i] has created a void that is being aggressively filled by merchants bypassing brick and mortar stores and developing natively as e-commerce retailers, such as Alibaba. This act of leapfrogging is analogous to the construction of mobile communication networks in many developing nations without first building landline infrastructure. As a result, perhaps, it is predicted that China will surpass the United States in online purchases as percentages of overall sales in the next year (Figure 1).

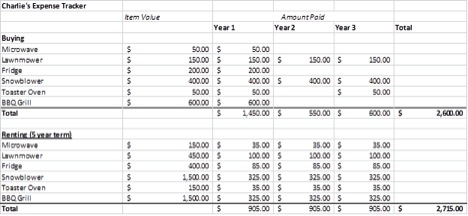

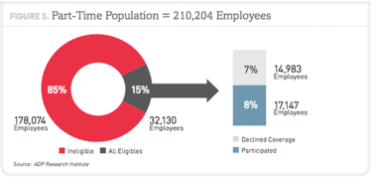

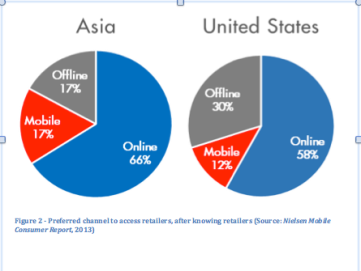

Mature corporations, such as Wal-Mart, view these emerging channels as complimentary to existing products, as part of a larger omni-channel system. Part of this view stems from existing consumers being conditioned to in-store experiences, but part is also influenced by a resistance to change from lifelong merchandisers either unfamiliar with online ecosystem, unimpressed with current offerings or unenthused by innovations that would disrupt their world. New merchants in China, free from internal pressures to maintain any existing physical channels and other 20th century merchandising mentalities, see these systems differently, most likely as substitutes that are both less costly than traditional channels and that best cater to regional consumer preferences (Figure 2).

Mature corporations, such as Wal-Mart, view these emerging channels as complimentary to existing products, as part of a larger omni-channel system. Part of this view stems from existing consumers being conditioned to in-store experiences, but part is also influenced by a resistance to change from lifelong merchandisers either unfamiliar with online ecosystem, unimpressed with current offerings or unenthused by innovations that would disrupt their world. New merchants in China, free from internal pressures to maintain any existing physical channels and other 20th century merchandising mentalities, see these systems differently, most likely as substitutes that are both less costly than traditional channels and that best cater to regional consumer preferences (Figure 2).

Not only do these changes point towards a fall in demand for physical stores themselves, but they will apply significant pressure to Wal-Mart’s already slim margins.

The primary offerings in the e-commerce world fall under the category of durable goods, such as clothing, toys, and electronics. This is precisely the same category of goods that Wal-Mart hopes consumers will buy at some point during visits to their stores.

Wal-Mart’s intense success surrounding grocery sales in the United States and abroad was centered on the possibility of cross-selling durable goods to consumers who flocked to Wal-Mart grocery sections to purchase foodstuffs at low cost, which at times meant a loss to Wal-Mart. The low-margin or loss on groceries would then be made up for by purchases made in other departments. With rising consumer interest in making those purchases online, the dropping cross-selling benefits will force Wal-Mart to re-evaluate this strategy.

With online availability of these durable goods and consumer preferences favouring online channels, it’s clear that Wal-Mart has to change its Chinese operations to adapt to this strong threat. However, with an underdeveloped online channel that only sells a small selection of the 140,000 SKUs offered in-store, it’s not clear that the discount giant has taken this threat seriously. Considering the competition, Alibaba’s various channels measure their product offerings in the tens or hundreds of millions[ii], orders of magnitude greater.

Wal-Mart is likely already feeling some pressure from better positioned retailers in China. Recently, there have been several changes in Wal-Mart China’s upper-level management following allegations of fraudulent accounting and nefarious business practices[iii]. These practices were made to make operations look better than reality in order to align with corporately-mandated goals. When goals are so unreasonably high that employees are willing to break laws to meet them, it seems prudent that Wal-Mart should change either the goals, how they are measured, or how they are rewarded. There is no sign that there have been any fundamental changes to Wal-Mart’s systems since the rise of these allegations.

Wal-Mart truly excelled when it first became a one-stop shop for shoppers, utterly changing the face of retail shopping. However, the marketplace is shifting, and doing so in China at a rapidly increasing rate. It took 150 years for the United States to move from an offline retail format to e-commerce. China took 20 years.

With that incredible rate of growth, savvy players in the Chinese marketplace were able to build their businesses around a dynamic, modern market place and have been beating the world champion at their own game. Eventually other markets will make the leap and judging from the lack of a truly innovative response from Wal-Mart to date, it’s not inconceivable that further missteps could cause this giant to fall.

[i] China has 0.6 m2 of retail space per capita versus 2.6 m2 in USA and 1.3 m2 in Europe (Source: Euromonitor)

[ii] Taobao, Alibaba’s consumer to consumer marketplace, has over 1 billion products and services listed (Source: HSBC Global Research, Chi Tsang)

[iii] How Wal-Mart made its crumbling China business look so good for so long, Renee Dudley & Liza Lin, Bloomberg, 2014