By Zhengyu (James) Fang and Peter Li

In January 2015, Wal-Mart announced that by the end the month it would open another 11 supercenters in Canada, realizing its expansion plan north of the boarder. In contrast with its ambitious footprints in Canada, the company cut 210 jobs last November, most of which was among head office headcounts in Mississauga Ontario, to “create a more efficient organizational structure as the company positions itself competitively for the future”, according to Andrew Pelletier, the company’s vice-president of corporate affairs and sustainability. The same thing is happening in both its home and international battlefields – the company shrank its regional office in China [1], and allegedly cut 700-800 jobs at Arkansas headquarters last year [2]. Facing stagnant growth in recent years and intense competition, Wal-Mart has spared little effort in decreasing operational expense to satisfy the shareholders. The retail giant’s high turnover rate of employees has been a sore point of criticism. This time, however, the company is doing the right thing to both cut operational costs and to solve its current public disputes on labor costs and employee welfare.

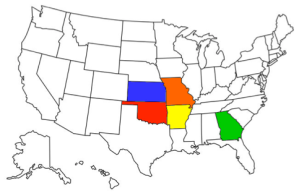

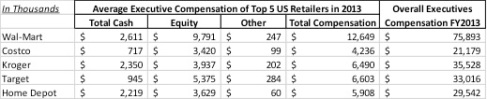

It is no secret that store managers of Wal-Mart are paid better than most of its competitors. According to National Bureau of Economic Research, average annual salary of a Wal-Mart store manager is about $92.5K, which is among the “highest paid in the nation”[3]. Same-level manager at Whole Foods and Starbucks are p aid on average $76K and $45K. Although Costco store manager is paid about 15% more than Wal-Mart, it is noticeable that cashiers at Costco are making more than 40%, and Whole Foods more than 20% than those in Wal-Mart. On the other hand, senior executives of Wal-Mart are paying way higher than those of its major competitors, as illustrated below [4]. An average senior executive took home $12.6 million compensation, which almost doubled runner up Target. For each hour, a Wal-Mart senior executive earns over $6,000 dollars, comparing with less than $10 dollars of an associate. Middle management is also arguably enjoying a higher than average compensation package. District managers could earn more than $240K, and regional vice presidents could reach over $420K [5].

aid on average $76K and $45K. Although Costco store manager is paid about 15% more than Wal-Mart, it is noticeable that cashiers at Costco are making more than 40%, and Whole Foods more than 20% than those in Wal-Mart. On the other hand, senior executives of Wal-Mart are paying way higher than those of its major competitors, as illustrated below [4]. An average senior executive took home $12.6 million compensation, which almost doubled runner up Target. For each hour, a Wal-Mart senior executive earns over $6,000 dollars, comparing with less than $10 dollars of an associate. Middle management is also arguably enjoying a higher than average compensation package. District managers could earn more than $240K, and regional vice presidents could reach over $420K [5].

Cutting cost at manager and above levels, we believe, is both necessary and imperative through either cutting the headcounts in head offices around the world, or slashing the staggering high paychecks of senior management, or even both. Costs saved by such initiatives could be used to subsidize front-line associates to their pay increase and life-saving social welfare. By doing so, the company could also show the public its efforts to solve its notorious labor issues, saving millions of tax payers’ dollars. Wal-Mart is on the right track of slashing jobs in head office, but it needs to do more.

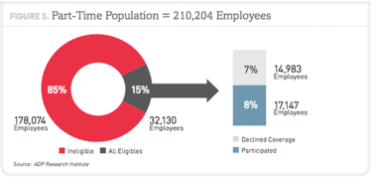

It is worth comparing Wal-Mart with its biggest competitor Costco here. As illustrated above and based on data compiled by Morningstar, Costco’s executive compensation totaled $21 million for 2013, actually a 6.68% decline from the previous year, while Wal-Mart’s executive compensation totaled $77 million in 2014, showing a 9.04% increase from 2013 [6]. In contrast, Wal-Mart pays $8.53 on average to its cashiers, but Costco pays $15.6. While Wal-Mart announces that “more than half” of its employees had health insurance coverage, Costco has 88% for the same statistics [7]. In terms of revenue growth, Costco had a soaring total 51.54% from 2010, while Wal-Mart only had 17.73%. When Costco announced a remarkable 10% growth in sales in August 2014, Wal-Mart struggled with a 2.8% increase for the same period [8]. One should be very curious about why Wal-Mart struggling in cutting every penny from store-level associates generously increased the compensation for their executives while Costco enjoyed vivid growth but shared more of their gains with their own employees.

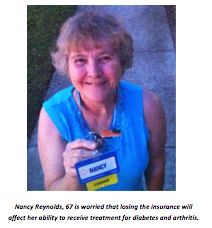

Figures are more telling when we go beyond financials. Wal-Mart’s current low labor cost strategy is actually hurting its bottom line rather than helping it. If we consider “all-in costs” of such a strategy, it is actually paying its employers more in order to improve in-store performance, retain reputation, and reduce the cost from potential law suits, all of which are not reflected on its financial statements but could have been saved otherwise. Statistics shows that Wal-Mart’s overall employee turnover rate is about 44% in 2013 [9]; it could be as high as 70% at some stores. High turnover rates will not only hurt an organization’s productivity, but also damage the overall image of the employer. Costs associated with high turnover rate could include wasted employee training costs, additional time in recruiting, problematic team dynamics as well as low morale and productivity. Even though Wal-Mart tries to justify its human resource policy by stating that training and replacement costs are low for the work force at their stores, they could be completely wrong about it when they ignore the fact that the low wage has led to deteriorated service quality and employee satisfaction [10]. In 2013, Wal-Mart was ranked No.1 in the “10 worst retailers that have the lowest customer satisfaction” list [11]. From the news and media, things haven’t been improved much, if not becoming worse, in 2014. It is not surprising that the growth for Wal-Mart was only 1.5% in 2013-14 then. When Wal-Mart is suffering from low quality and drives away its customers, other retail stores are more than happy to welcome the outraged, anti-Wal-Mart force to join their customer base.

In conclusion, Wal-Mart is on the right track of redesigning its management structure in the head office, but that’s obviously not enough to fuel its long-term growth. It should revisit overall compensation scheme and must be well positioned to justify its staggering paychecks to those executives and senior management under stagnant period of business growth. Saved costs from these initiatives should be used to subsidize front-line associates, regardless of impending regulatory changes or not, so as to save its reputation, cut litigation costs and bring lost customers back to it.

References:

[1]. http://usa.chinadaily.com.cn/business/2014-12/03/content_19014719.htm

[2]. http://abcnews.go.com/Business/story?id=6850964

[3]. http://time.com/3026504/wal-mart-managers-average-salary-higher-than-starbucks/

[4]. Compiled by http://www1.salary.com from companies SEC filings

[5]. Always Low Wages, Lisa Featherstone, 2014

[6] http://blogs.wsj.com/corporate-intelligence/2014/07/23/pay-at-wal-mart-low-at-the-checkout-but-high-in-the-managers-office/

[7]. http://insiders.morningstar.com/trading/executive-compensation.action?t=COST

[8]. http://www.fool.com/investing/general/2014/09/05/why-costco-is-crushing-wal-mart.aspx

[9]. http://aattp.org/raising-employee-wages-could-actually-raise-walmarts-profit-margin/

[10]. http://www.forbes.com/sites/rickungar/2013/04/17/walmart-pays-workers-poorly-and-sinks-while-costco-pays-workers-well-and-sails-proof-that-you-get-what-you-pay-for/

[11]. http://www.washingtonpost.com/business/economy/these-10-retailers-had-the-worst-customer-satisfaction-ratings-for-2013/2014/02/27/a0860cb4-9f25-11e3-a050-dc3322a94fa7_story.html