By Nikhil Mittal and Hitendra Patel

October, 2014 marked the first anniversary of Wal-Mart’s exit from India. In 2013, when its joint venture with Indian conglomerate Bharti dissolved, Wal-Mart was left with only its 20 Best Price stores that operate in the Sam’s Club format[i]. While Wal-Mart is waiting for the Indian government to relax the foreign direct investment (FDI) rules in conventional retailing, Amazon is planning to benefit from the current regulations in e-commerce segment[ii]. The newly elected Indian government has chosen to delay the FDI related developments in the multi-brand retail sector[iii]. In such a situation, should Wal-Mart wait for the government to accept its conventional retail business model, or be flexible and try to become part of the growth story? We argue that Wal-Mart should reinvent its business model and enter India as an online player to strengthen its presence in the eastern part of the globe.

regulations in e-commerce segment[ii]. The newly elected Indian government has chosen to delay the FDI related developments in the multi-brand retail sector[iii]. In such a situation, should Wal-Mart wait for the government to accept its conventional retail business model, or be flexible and try to become part of the growth story? We argue that Wal-Mart should reinvent its business model and enter India as an online player to strengthen its presence in the eastern part of the globe.

Need to Reinvent the Model through New Markets

E-commerce is favourably seen as the creative destruction of the conventional retailing model. Various innovation theories have argued that when an industry faces profound changes (technological discontinuity), an entrant usually wins over the incumbent. With the meteoric rise of Amazon and Wal-Mart’s consequently flat or shrinking base in the USA, handcuffing itself with the conventional business model may turn out to be a fatal mistake in the long-term. Globalization provides Wal-Mart a unique opportunity to participate in the shifting paradigm (towards online) of retailing. The emerging markets, and especially India, present an opportunity for Wal-Mart to be in the entrant’s shoes again and use this discontinuity in the industry to reinvent its business model.

The Opportunity in India

It would be unreasonable to expect retail in a developing country to pass through the phases that it went through the United States around 30 to 40 years ago. While only 8% to 10%[iv] of the Indian retail market is organized, the e-commerce companies are becoming popular in the cities of India. It suggests that the country is about to skip major investments in organized retailing, and switch directly from the mom and pop stores to the e-commerce platforms. These newly evolved e-commerce companies are pushing the new business model in India, and the market is gradually preparing for large scale activities. For example, Flipkart, the largest online retailer in India, has ~ 22 million registered users and recently raised $1 billion for its development[v]. Moreover, Amazon has committed US $2 billion for its expansion into India. None of these were strong players less than 2-years ago, and it would take another 3 to 5 years before they figure out the local logistic and supply chain. According to a report by A.T.Kearney, India is one of the most attractive and time critical markets[vi]. Essentially, time is of great essence here, and wait and watch might not prove to be a fruitful strategy.

Some may argue that a country like India is not yet ready for online retailing, and Amazon and others may have to wait another decade before they realize any profit. Note that, the initial signs of organized retailing in India have been reasonably promising. For example, a few Indian retailers such as Big Bazaar, EasyDay, Shopper Stop and Reliance Fresh have expanded in the hope of changing consumer preferences[vii]. They have made an impact and been moderately successful in the urban markets. Above all, like any other business, online retailing will require initial investments and a loyal customer base that will build over time to be successful.

Readiness of Customers

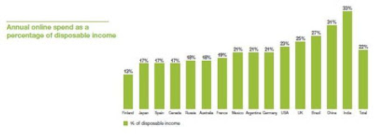

Approximately 30% of the Indian population, or 400 million people, live in the urban areas. A similar number of people are part of the organized workforce, and approximately 50% of  them have access to the internet. According to a study by PwC, the Indian e-commerce market is growing at approximately 20% to 30% annually[viii]. With approximately 50% population, or 500 million people, below the age of 21, this growth is unlikely to slow in the near future[ix]. Along with the current population mix, the increasing penetration of internet and mobile users augurs well for e-commerce activities. Recent statistics also suggest that Indians spend 33% of their disposable income through the online channel[x].

them have access to the internet. According to a study by PwC, the Indian e-commerce market is growing at approximately 20% to 30% annually[viii]. With approximately 50% population, or 500 million people, below the age of 21, this growth is unlikely to slow in the near future[ix]. Along with the current population mix, the increasing penetration of internet and mobile users augurs well for e-commerce activities. Recent statistics also suggest that Indians spend 33% of their disposable income through the online channel[x].

Despite all the positive signals, the proponents of a stable market may not like to invest in an emerging market for its political instability and economic changes. The recent changes in Indian politics have made it challenging to predict upcoming regulations. Moreover, the inflationary environment poses additional risk to the discount retailing business. These reasons highlight the high risks and probability of failure. As a result, Wal-Mart should use a risk-adjusted approach to evaluate the return on long-term investment in developing countries. Such a decision metric would account for the poor infrastructure and supply-chain problems.

To conclude, by venturing into the online retail channel in India, Wal-Mart has access to a large market where customers are ready for the plunge. Meanwhile, Wal-Mart’s competitors are aggressively investing to understand consumer preference, build their supply chain and develop local expertise. Facing a potential disruption in the conventional retailing, Wal-Mart needs to reinvent its business model. With its large customer base and moderately strong IT infrastructure, India is an ideal market for the Wal-Mart online retailing experiment.

Sources

Chart source: MarketingCharts.com. http://www.marketingcharts.com/uncategorized/us-online-shoppers-spend-23-of-disposable-income-online-21905/

[i] http://news.walmart.com/news-archive/2013/10/09/bharti-enterprises-walmart-stores-inc-announce-agreement-to-independently-own-operate-separate-business-formats-in-india

[ii] http://www.foxnews.com/tech/2014/08/07/amazon-sees-potential-in-india-but-faces-big-challenges/

[iii] http://www.thehindu.com/business/india-to-disallow-fdi-in-multibrand-retail-nirmala/article6391737.ece

[iv] http://www.ficci.com/sector/33/Project_docs/Sector-prof.pdf

[v]http://timesofindia.indiatimes.com/tech/tech-news/Flipkart-Amazon-build-3-billion-war-chest-nearly-the-size-of-Indian-online-retail-market/articleshow/39379711.cms, http://data.worldbank.org/indicator/SP.RUR.TOTL

[vi] http://www.atkearney.com/consumer-products-retail/global-retail-development-index/past-report/-/asset_publisher/r888rybcQxoK/content/2012-global-retail-development-index/10192

[vii] http://articles.economictimes.indiatimes.com/2013-10-08/news/42829309_1_big-bazaar-direct-kishore-biyani-future-group

[viii] https://list2.pwc.fr/assets/files/lettre_retail-and-consumer/pwc_winning_in_india_retail_sector_1.pdf

[ix] http://censusindia.gov.in/(S(u3psu355n3hque454wwdoqzv))/Census_And_You/age_structure_and_marital_status.aspx

[x] http://www.marketingcharts.com/uncategorized/us-online-shoppers-spend-23-of-disposable-income-online-21905/