By Katherine Fan, Shantanu Nigam and Sissi Yang

On October 7th 2014, Wal-Mart announced it would discontinue health and other benefits starting 2015 for around 30,000 part-time employees who work 30 hours or less [1]. Not known as a particular employee friendly company, Wal-Mart has been criticized in the past for its low wages, gender and racial discrimination, and inadequate health insurance [2]. With the advent of the new Patient Protection and Affordable Care Act (a.k.a. Obamacare), Wal-Mart is once again at the center of public scrutiny for its latest move [3]. Wal-Mart has been a big supporter of Obamacare [4] and is being accused of taking advantage of new healthcare regulations to offload its own cost onto American taxpayers. However, looking digging further into Wal-Mart’s as well as government healthcare system in context of the Obamacare, we think that the employees, rather than Wal-Mart, would stand to gain more from this policy.

Part-time employees now qualify for financial subsidy for Medicaid healthcare insurance

Most part-time workers are forced to do so due to lack of sufficient full-time opportunities. They often work multiple part-time jobs to make sufficient living and seek every sponsorship and financial aid to help in expenses. One attraction of the employer sponsored healthcare plan for them is the tax-benefit on the premium paid towards the plan. However, most low-wage employees also qualify for the financial subsidy for government Medicaid healthcare plans at the exchange (known as Heath Insurance Marketplace) resulting in further savings. Employees weigh their healthcare options for the cheapest deal (tax benefit or financial subsidy) and make their choice. The new Affordable Care Act (Obamacare) has added a layer of complexity to it. Under the new provision, a low income individual may not qualify for subsidy if his/her employer offers health insurance at work even if the individual does not choose to buy it [5] [6]

For example, as calculated by Kaiser Family Foundation’s subsidy calculator [7], a low-wage employee at Wal-Mart with 2 kids and house hold earning of $22,000, which is below poverty line[8], would still not qualify for the government financial aid for private insurance at the state exchange (cheaper alternative) if he/she is offered healthcare by Wal-Mart; Even if he/she choose not to buy Wal-Mart insurance. By removing the healthcare provision for the same employee, Wal-Mart actually enables him/her for annual government financial aid of $5700.

hold earning of $22,000, which is below poverty line[8], would still not qualify for the government financial aid for private insurance at the state exchange (cheaper alternative) if he/she is offered healthcare by Wal-Mart; Even if he/she choose not to buy Wal-Mart insurance. By removing the healthcare provision for the same employee, Wal-Mart actually enables him/her for annual government financial aid of $5700.

Government offers better and more reliable Healthcare coverage than Wal-Mart

Another indirect benefit from Wal-Mart’s move, is that employees now access to better and more reliable healthcare coverage. As sited by ‘Walmart-Watch’, a Washington based non-profit organization, Wal-Mart healthcare is highly inadequate especially with the advent of Obamacare [9]. Wal-Mart’s insurance include high deductible compared to other public and private options; involve long waiting period before the worker becomes eligible for healthcare. Pre-existing conditions require further wait-period for employees to become eligible for healthcare; ambulance, and emergency services require extra charges while preventive care has prohibitively high deductible under Wal-Mart’s healthcare plan. In comparison government provided Medicaid covers ambulance service [10], preventive health service [11], include pre-existing conditions [12], and does not involve waiting period [13].

For part time employees eligible for subsidy, Wal-Mart’s healthcare plans are more expensive than comparable government plans. As sited in the Walmart Watch report, a $700 deductible healthcare plan with $4000 out-of-pocket expenses costs $700f0, something unaffordable for an employee earning $20,000. The recent hike to the premium [14] has made Wal-Mart’s healthcare plan even more undesirable. The case with part-time employees earning too high to qualify for subsidy is different as the premium for Wal-Mart Healthcare plan is relatively cheaper than unaided premium of the Medicaid [15]. However it is highly improbable for a minimum wage employee working less than 30 hours per week to not qualify for any subsidy.

Not only inadequate and expensive in case of Wal-Mart, an employer based healthcare program in general is inherently an unreliable mode of insuring oneself for the time of emergency. As Washington Post’s Paul Waldman mentions, the insurance coverage should not depend on the employer [16]. It should not be impacted with the loss or change of job/career; it should not designed based on the will of the employer such as which illnesses to cover and when to cover etc. There is no reason to outsource these choices to a middleman, the employer.

Wal-Mart saves on insurance cost. But how much?

Although Wal-Mart’s senior management has been shying away from disclosing the cost savings resulting from the change in plan [17], Bloomberg estimates Wal-Mart could save roughly $50 million in cost assuming 30,000 affected workers use lowest-cost plan [18].

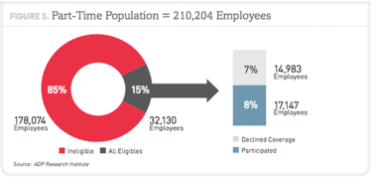

Under the new plan, Wal-Mart’s lowest-cost health plan would cost an employee $21.90 per pay period [19]. Paying biweekly and covering 75% of the total premium, Wal-Mart incur an overhead of $66 per pay period per employee. Contrary to Bloomberg’s assumption that all 30000 part-time employees buy Wal-Mart health insurance, ADP Research Institute report showed that only 8% of total part-time workers (approx. 17000 of 210,000) actually bought the cov erage in 2013 [20]. Hence under the conservative estimates Wal-Mart could save the annual insurance overhead of only about $29 million at current subscription rate. A meagre saving for a half trillion dollar company.

erage in 2013 [20]. Hence under the conservative estimates Wal-Mart could save the annual insurance overhead of only about $29 million at current subscription rate. A meagre saving for a half trillion dollar company.

[Image Source: ADP Resource Institute; http://www.vox.com/2014/10/7/6939057/walmart-drops-insurance-good-news]

Conclusion

Wal-Mart has openly stated its concerns about the rising healthcare costs and its recent action is no surprise. Obamacare mandates employer to provide a quality and affordable healthcare coverage to all full-time equivalent (FTE) employees. It also takes care of those left out of employer sponsored healthcare insurance. Looking at the opportunity to reduce cost, every firm including Wal-Mart, is now restructuring its workforce by cutting working hours of employees to reduce FTE workforce, as well as cutting benefits in compliance of the mandate. The change in its policies and benefit structure might save some costs for Wal-Mart, we believe it has done more good to the employees who could now avail government financial subsidy and a better more reliable healthcare program.

Reference

[1] Wal-Mart drops healthcare for some part-time employees http://www.wsj.com/articles/wal-mart-to-end-health-insurance-for-some-part-time-employees-1412694790

[2] Criticism of Wal-Mart http://en.wikipedia.org/wiki/Criticism_of_Walmart

[3] Obamacare Explained http://obamacarefacts.com/obamacare-explained/

[4] Wal-Mart supporter of Obamacare http://www.weeklystandard.com/blogs/walmart-obamacare-supporter-drops-coverage-another-30000-employees_810824.html

[5] Obamacare brings change in healthcare regulations http://www.vox.com/2014/10/7/6939057/walmart-drops-insurance-good-news

[6] Eligibility for Health Premium Subsidy http://www.zanebenefits.com/blog/bid/288577/ACA-Limits-Premium-Subsidies-For-Families-of-Covered-Employees

[7] Kaiser Family Foundation’s subsidy calculator

http://kff.org/interactive/subsidy-calculator/#state=&zip=&income-type=dollars&income=22000&employer-coverage=0&people=2&alternate-plan-family=individual&adult-count=1&adults%5B0%5D%5Bage%5D=36&adults%5B0%5D%5Btobacco%5D=0&child-count=2&child-tobacco=0

[8] Poverty Threshold http://www.irp.wisc.edu/faqs/faq1.htm#thresholds

[9] Wal-Mart Watch report – Wal-Mart healthcare is inadequate http://walmartwatch.com/wp-content/blogs.dir/2/files/pdf/medicaid_factsheet.pdf

[10] Medicaid covers ambulance service http://kff.org/medicaid/state-indicator/ambulance-services

[11] Medicaid covers preventive health service https://www.healthcare.gov/preventive-care-benefits/adults

[12] Medicaid covers include pre-existing conditions http://obamacarefacts.com/whatis-obamacare]

[13] Medicaid [http://en.wikipedia.org/wiki/Medicaid]

[14] Recent hike to Wal-Mart premium http://www.reuters.com/article/2012/11/12/walmart-healthcare-idUSL3E8MC18E20121112

[15] Wal-Mart Healthcare plan is cheaper than that under Medicaid http://www.washingtonexaminer.com/surprise-walmart-health-plan-is-cheaper-offers-more-coverage-than-obamacare/article/2541670

[16] Insurance coverage should be employer independent http://www.washingtonpost.com/blogs/plum-line/wp/2014/10/08/how-walmart-is-showing-that-obamacare-is-working/

[17] Wal-Mart will not disclose cost savings http://www.wsj.com/articles/wal-mart-to-end-health-insurance-for-some-part-time-employees-1412694790

[18] Bloomberg estimates Wal-Mart could save roughly $50 million in cost http://www.bloomberg.com/news/2014-10-07/wal-mart-will-cut-health-benefits-to-some-part-time-employees.html.

[19] Wal-Mart healthplan cost http://www.bloomberg.com/news/2014-10-08/wal-mart-health-cuts-reopen-debate-over-obamacare-costs-savings.html

[20] 8% of total part-time workers actually bought Wal-Mart coverage in 2013 – ADP Research Institute Report http://www.vox.com/2014/10/7/6939057/walmart-drops-insurance-good-news